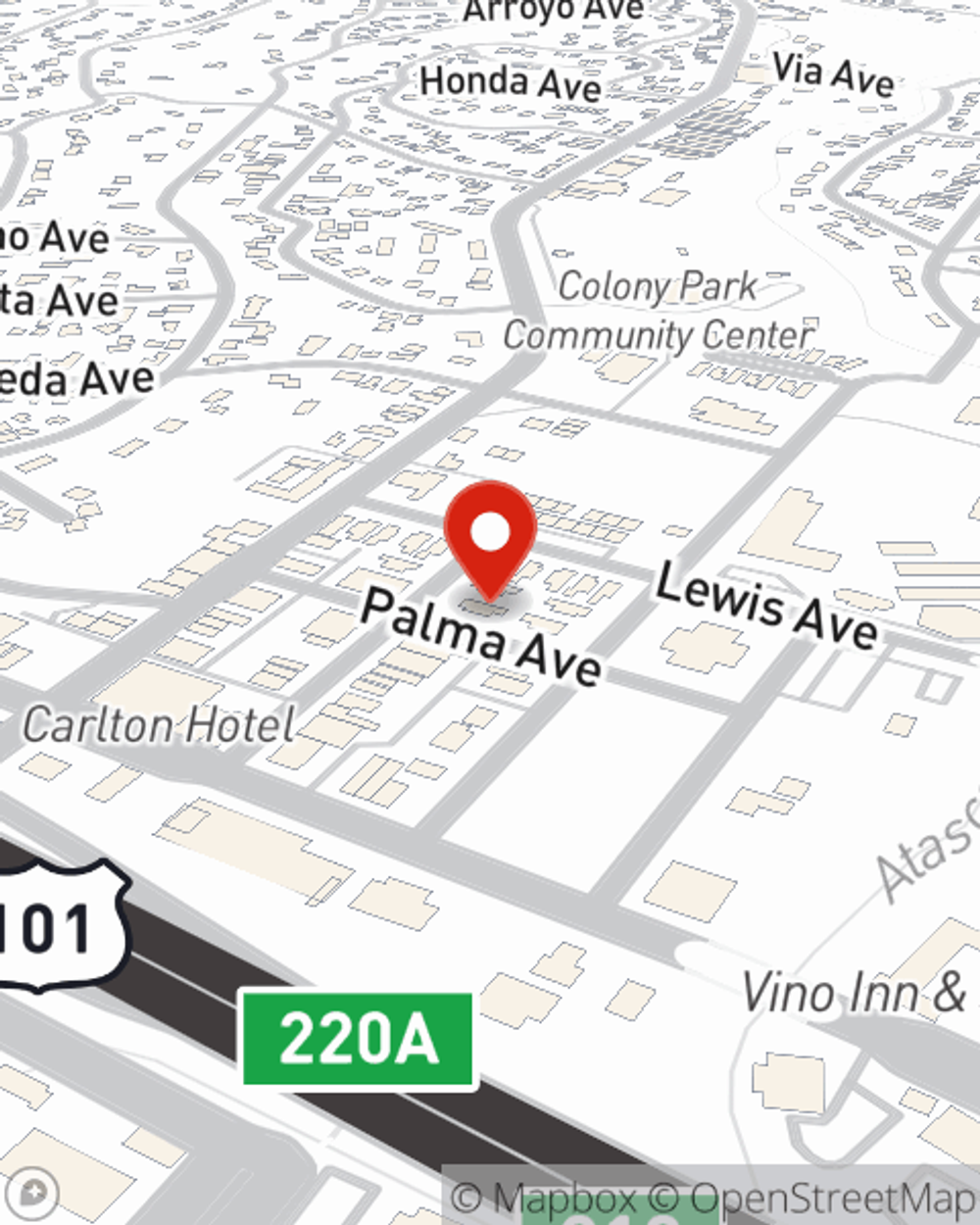

Life Insurance in and around Atascadero

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Oceano

- Morro Bay

- Arroyo Grande

- Pismo Beach

- Cayucos

- Los Osos

- Cambria

- Avila Beach

- Paso Robles

- Templeton

- Santa Margarita

- San Miguel

- Lompoc

- San Luis Obispo

- Oregon

- Arizona

- Nevada

Your Life Insurance Search Is Over

The common cost of funerals in this day and age is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your loved ones to manage that expense as they mourn. That's where Life insurance with State Farm comes in. Having the right coverage can help your family afford funeral arrangements and not experience financial hardship.

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Atascadero Chooses Life Insurance From State Farm

You’ll get that and more with State Farm life insurance. State Farm has fantastic coverage options to keep those you love safe with a policy that’s modified to correspond with your specific needs. Thank goodness that you won’t have to figure that out on your own. With deep commitment and terrific customer service, State Farm Agent Sara Hays walks you through every step to provide you with coverage that guards your loved ones and everything you’ve planned for them.

State Farm offers a great option for individuals who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can be helpful by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For help with all your life insurance needs, contact Sara Hays, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Sara at (805) 466-9400 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.